TIS

Optimising the world of enterprise payments and intelligent fraud prevention

Company’s background

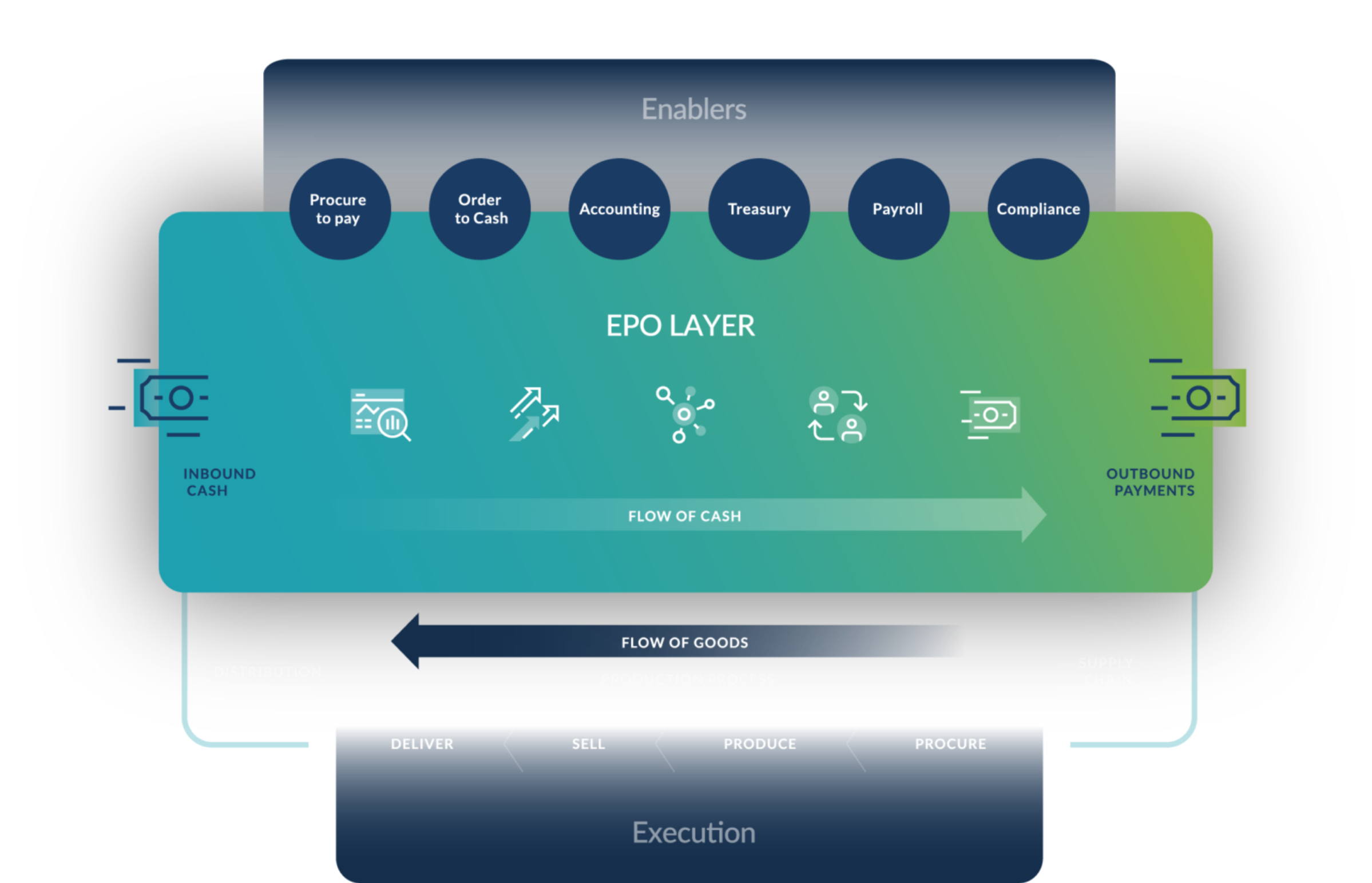

TIS is reimagining the world of enterprise payments through a cloud-based platform uniquely designed to help global organizations optimize outbound payments.

Corporations, banks and business vendors leverage TIS to transform how they connect global accounts, collaborate on payment processes, execute outbound payments, analyse cash flow and compliance data, and improve critical outbound payment functions.

Vision

Founded in 2010 as Treasury Intelligence Solutions, we’re realizing a vision of a fully connected world of payments.

For more information on TIS, please visit the TIS website.

Vision

Founded in 2010 as Treasury Intelligence Solutions, we’re realizing a vision of a fully connected world of payments.

For more information on TIS, please visit the TIS website.

Modules

Bank Account Management

Most global organisations lack comprehensive insight into cash flows. At the heart of this challenges is the need for effective bank account management. Ranking as the most frustrating process for treasurers at global enterprises, the process of managing, closing and opening accounts worldwide — while staying compliant with multinational regulations — is complicated, time-consuming and inefficient.

With hundreds or thousands of bank accounts worldwide, global cash flow visibility across these accounts can feel impossible – but it’s critical for effective liquidity management.

Corporate Payment Platform

Our award-winning enterprise payments platform represents the global standard in outbound payment optimisation. Increase payment visibility, improve organisational alignment, lower fraud risk, accelerate connectivity and gain strategic advantage – all with a single, cloud-based technology platform.

Intelligent Fraud Prevention

Enterprise payments fraud is more elaborate and subversive than ever before. Within the past year alone, thousands of finance and treasury practitioners across the world have learned through bitter experience that digital payments fraud is rarely orchestrated by your average, everyday criminal.

Rather, the vast majority of today’s technology-oriented attacks, particularly those that target large enterprises, are led by sophisticated, well-funded, and innovative fraudsters.

get in touch with us

Interested to find out more?

Leave us a message and we will get back to you.